Even in today’s digital world, writing a check remains an essential skill. Whether you’re paying rent, covering a deposit on a home, or navigating an old-school transaction, knowing how to fill out a check can save you time—and possibly some processing fees. While many of us lean on debit cards, mobile payments, and digital banking, there are still moments when a check is the preferred or only option.

So, if you’re wondering how to write a check or simply need a quick refresher, this guide will walk you through the process, step by step. You might be surprised by how useful this traditional method of payment can still be.

Why You Might Need to Write a Check

Although it may feel like a relic of the past, there are certain situations where writing a check is not only useful but required. Here are a few common examples where knowing how to write a check is still necessary:

- Rent or down payments: Many landlords and sellers still request checks for security deposits or monthly payments.

- Gifts for special occasions: For weddings, graduations, and other milestones, checks often serve as thoughtful, tangible gifts.

- Government services: Some government offices, such as DMVs or permit offices, accept only checks to avoid credit card processing fees.

- Small business payments: Independent contractors or small businesses may prefer checks due to lower transaction costs.

- Campgrounds or remote facilities: Some national parks and campgrounds operate entirely on check payments, especially in more remote areas with limited technology.

Even if you don’t write checks often, keeping a checkbook on hand can be incredibly convenient in these situations. Now, let’s get into the specifics of how to properly fill one out.

Step-by-Step: How to Write a Check

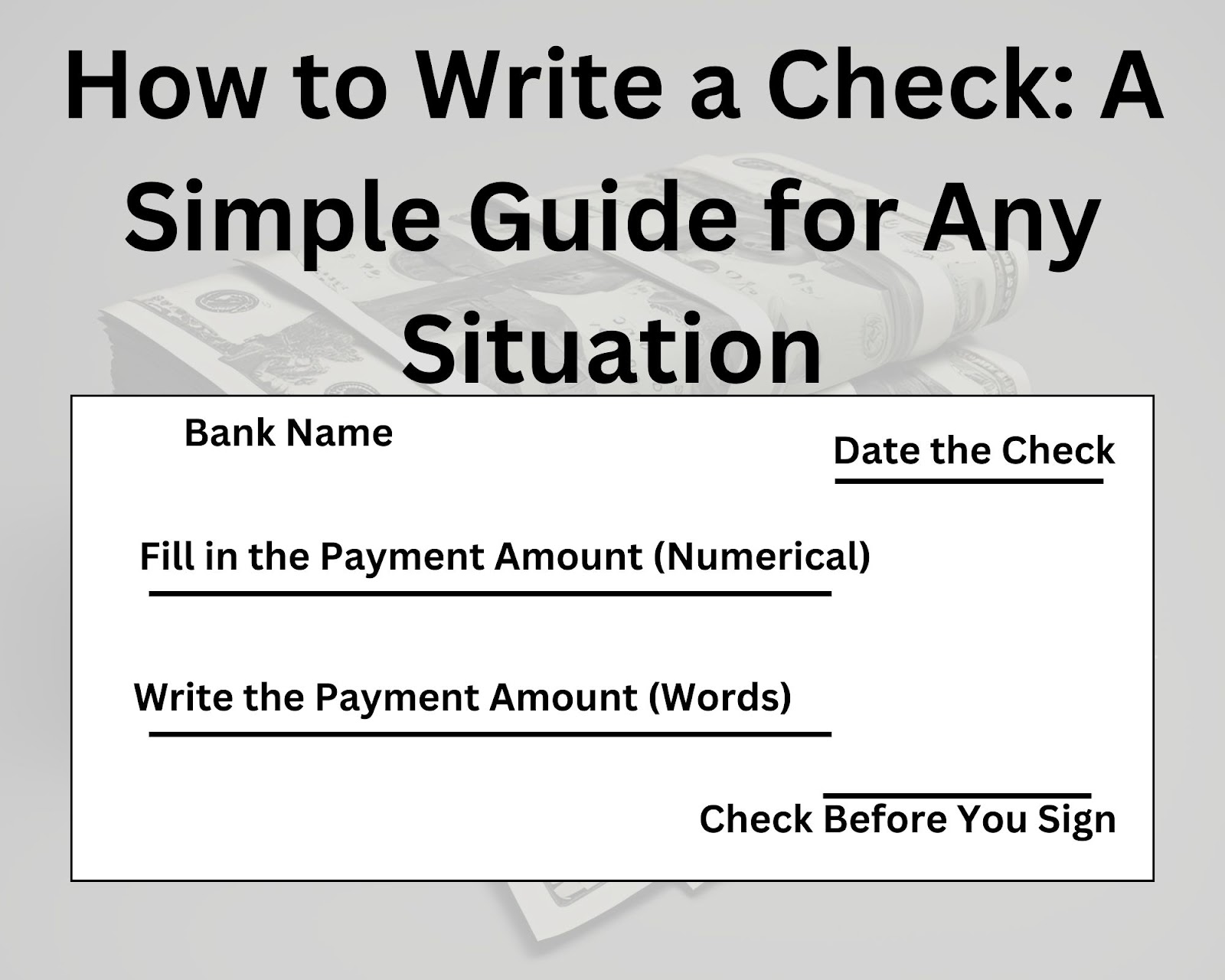

When you’re holding a blank check, it might seem daunting at first. But once you break it down, filling out a check is quite simple. Here’s how to write a check in six easy steps:

- Date the Check

In the top right corner, you’ll find a line where you write the date. This can be written in any standard format (MM/DD/YYYY), and it’s essential for verifying when the check was issued.

- Write the Payee’s Name

On the line labeled “Pay to the Order of,” write the name of the person or business you’re paying. Be sure to spell everything correctly and legibly to avoid any issues when they deposit or cash the check.

- Fill in the Payment Amount (Numerical)

Next to the payee’s name, you’ll see a small box where you write the payment amount in numbers. For example, if you’re paying $125.50, you would write “125.50” in this box.

- Write the Payment Amount (Words)

On the line directly beneath the payee’s name, write out the dollar amount in words. For example, “One hundred twenty-five dollars and 50/100.” This is a crucial step as banks use this line to confirm the check’s amount. If there’s a discrepancy between the numbers and the words, the written amount will typically prevail.

- Memo Line (Optional but Useful)

The memo line at the bottom left of the check is where you can specify the purpose of the payment. Whether it’s for “rent,” “plumbing repairs,” or “wedding gift,” this is your space to remind the payee (and yourself) of the transaction’s purpose.

- Sign the Check

Finally, sign your name on the signature line in the bottom right corner. Without a signature, the check is not valid. Use the same signature that’s on file with your bank to ensure it’s accepted without any issues.

Tips for Filling Out a Check

While the process may seem straightforward, here are a few additional tips to ensure that your checks are written properly every time:

- Use a pen: Always use a blue or black ink pen to write your checks. This makes it harder for someone to alter any details and ensures the information stays legible over time.

- Avoid abbreviations: When writing out the payee’s name or the payment amount, avoid using abbreviations that might confuse the bank or the recipient. Clarity is key.

- Double-check the amount: Before you hand over the check, double-check that the written and numerical amounts match. Even small errors can cause headaches for both you and the payee.

Why Knowing How to Write a Check Still Matters

In a world of instant transfers and mobile apps, you might wonder why you even need to know how to write a check. But checks can be incredibly useful in scenarios where digital payments aren’t feasible or where transaction fees add unnecessary costs.

Take government offices, for example. Many places charge a processing fee when you use a credit or debit card. A check, on the other hand, avoids that fee altogether, saving you a few dollars. Plus, checks serve as a paper trail, providing both you and the payee with a record of the transaction.

Another important factor? Not everyone has transitioned to the digital world. Small business owners, particularly independent contractors or local service providers, often prefer checks for the lower fees and the simplicity of depositing funds. So, whether you’re paying your gardener or hiring a plumber, writing a check can be a smart way to avoid additional charges.

Final Thought: Keep the Skill in Your Toolbox

Writing a check may not be the go-to method for most transactions anymore, but it remains a useful skill to have. Whether you’re paying rent, gifting money for a wedding, or dealing with a contractor, knowing how to fill out a check correctly can save you time, fees, and potential headaches.

In those rare but important situations where writing a check is necessary, you’ll be glad you took the time to learn the process. It’s a straightforward task, but one that keeps you prepared for those moments when digital isn’t an option.